When it comes to accepting credit card payments, not all processors operate the same way—and that difference matters more than you think.

Many businesses assume their funds are safe simply because they use a well-known processor. But in reality, the way a processor handles your money can expose your business to unnecessary risk—from delayed payouts to, in extreme cases, total loss of access to your own funds.

Some providers take shortcuts by using risky pooled fund structures that centralize money from multiple businesses into a single account. If that system fails? Every business using it pays the price.

At Basys, we take a fundamentally different approach—one that prioritizes security, stability and trust.

Here’s what you need to know.

The Payment Models That Affect Your Business

Behind every transaction, there’s a funding process—and not all of them are built to protect your business.

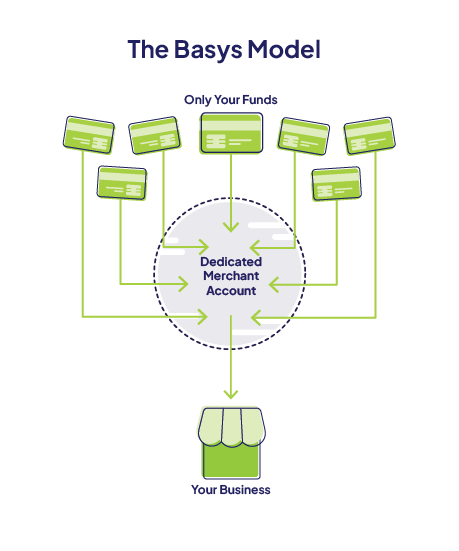

A More Secure Approach: Dedicated Business Accounts

- Each business has its own account.

- Transactions are processed within a closed system—funds flow directly between your business, the bank and the processor.

- Your money is never at risk due to another business’s financial situation.

This is how Basys operates. It’s a model built for transparency, reliability and long-term financial stability.

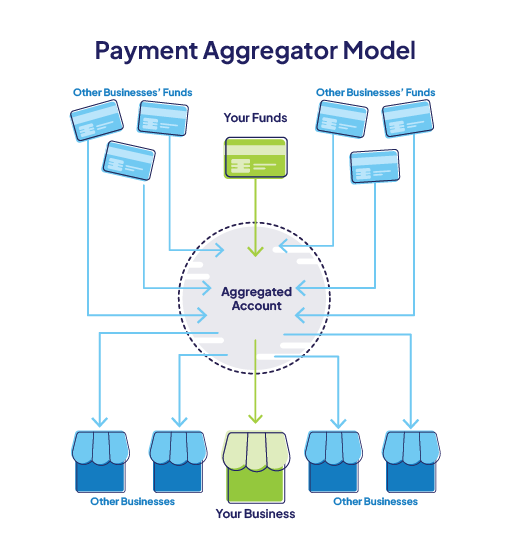

A Higher-Risk Model: Pooled Funds

- All businesses’ funds are combined in one central account.

- The processor controls fund movement internally, rather than directly connecting businesses to the bank.

- If the processor mismanages cash flow or experiences a financial shortfall, your business could be impacted—even if you did everything right.

This structure prioritizes quick setup over financial security—and time and time again, businesses relying on this model have faced catastrophic consequences.

When Payment Models Go Wrong: A Real-World Example

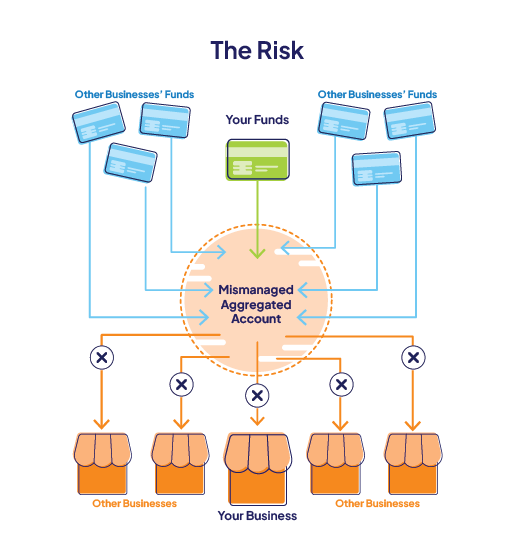

To understand the real risk, consider a recent high-profile fintech failure that left businesses without access to their own funds.

In this case, a third-party provider operated under a pooled funds model, combining business funds into a single account instead of keeping them separate. This provider was responsible for tracking individual balances, managing cash flow and covering fees associated with their banking partner.

But then the cracks started to show:

- They miscalculated fees, leading to unexpected shortfalls.

- They failed to manage cash reserves, running out of money.

- When businesses tried to access their funds, the money wasn’t there.

The blame game ensued—the aggregator pointed at the bank, and the bank pointed at the aggregator. But the businesses using this system were left scrambling, unable to access their money.

Situations like this aren’t theoretical. They’re happening in fintech right now. And if you’re working with a processor that doesn’t prioritize financial security, your business could be at risk, too.

Why Basys Is the Smarter, Safer Choice

We don’t take shortcuts. We don’t use risky pooled fund models. And we never put your money at risk.

Here’s what sets Basys apart:

- Privately held & financially stable: No outside investors. No short-term profit plays. Just long-term, customer-first decisions.

- No pooled funds: Your business has its own dedicated account, keeping your money secure.

- Direct relationships with financial institutions: Transactions flow transparently and securely—no intermediaries, no unnecessary risk.

- Proven track record of integrity & reliability: Basys has been trusted for over 20 years because we do things the right way.

In payment processing, the right decision isn’t just about rates or features—it’s about trust. And when it comes to protecting your money, trust isn’t optional.

Choose Stability. Choose Security. Choose Basys.

If you’re working with a processor that pools funds, relies on internal money movement or lacks financial transparency, now is the time to reconsider.

Your business deserves a payments partner that prioritizes your security, not their convenience.

At Basys, we’ve built our reputation on doing things the right way—because when it comes to your money, nothing less will do.

Let’s talk.

General Contact

"*" indicates required fields