If you accept credit or debit cards, chargebacks are an unavoidable part of doing business. But understanding how they work—and taking the right steps to prevent them—can help protect your revenue and keep disputes from disrupting your cash flow.

What Is a Chargeback?

A chargeback occurs when a customer disputes a transaction with their card issuer, triggering a reversal of funds from your business. Unlike a traditional refund, which you process directly with the customer, a chargeback bypasses you entirely. The cardholder’s bank reviews the dispute, and if deemed valid, the transaction is reversed, pulling money from your account.

Chargebacks can happen for several reasons, including:

✅ The customer didn’t recognize the transaction

✅ They claim they never received the product or service

✅ They believe they were charged incorrectly or fraudulently

✅ There was an issue with the quality of the product or service

Regardless of the reason, chargebacks can cost your business time and money. That’s why it’s critical to know how to respond—and, more importantly, how to prevent them.

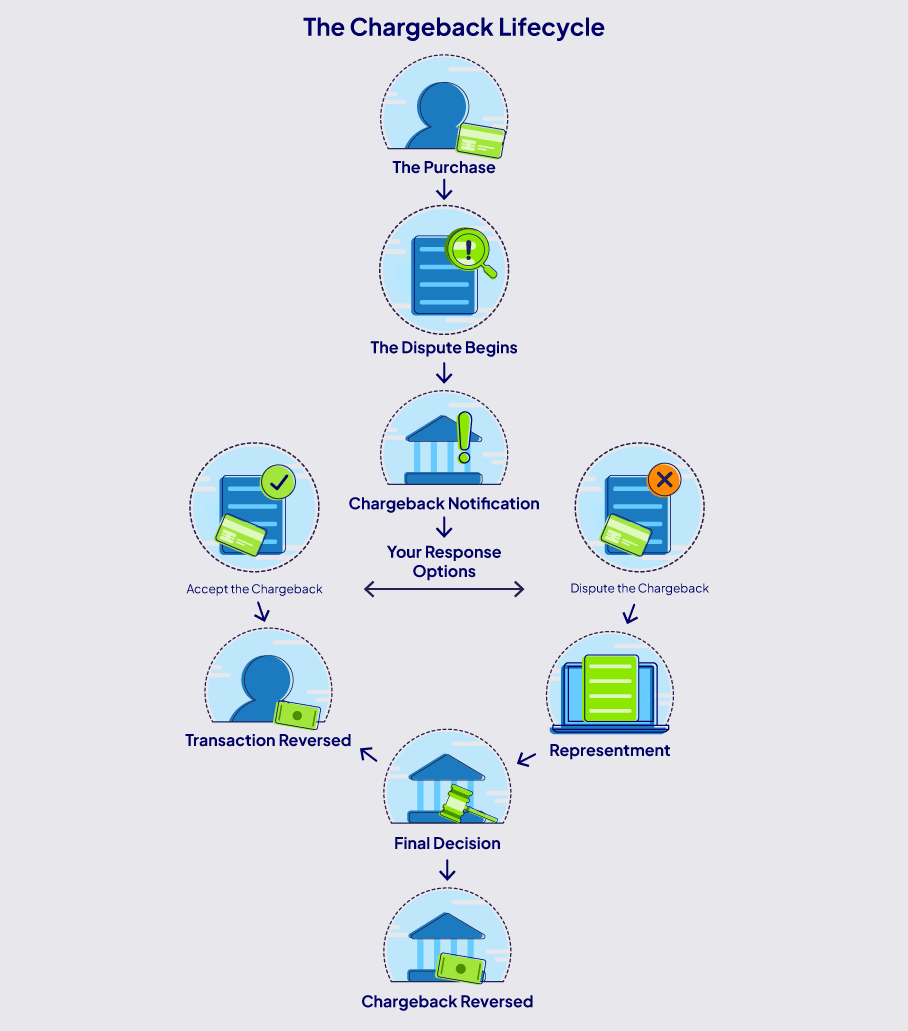

The Chargeback Process: What to Expect

Here’s a step-by-step look at how chargebacks unfold:

1️. A customer makes a purchase – The transaction is completed using a credit or debit card.

2️. The cardholder disputes the charge – The customer contacts their card issuer (the bank that issued their card) and claims an issue with the purchase.

3️. The card issuer reviews the dispute – If the claim appears valid, the issuer temporarily refunds the cardholder and initiates the chargeback process.

4️. You receive a chargeback notice – Your payment processor (Basys) notifies you of the chargeback.

5️. You choose how to respond – You can either:

- Accept the chargeback, meaning the refund to the customer is permanent.

- Dispute the chargeback, by submitting supporting evidence that proves the transaction was valid.

6️. Representment phase – If you dispute the chargeback, the card issuer reviews the evidence and makes a decision:

- If the issuer rules in your favor, the chargeback is reversed, and the funds are returned to your account.

- If the issuer upholds the chargeback, the funds remain refunded to the cardholder.

7️. Arbitration by the card networks (if necessary) – If either party disagrees with the decision, the dispute may escalate to the card networks (Visa, Mastercard, etc.), who will make the final ruling.

8️. Legal action (optional) – If the card brands rule against you, but you believe the chargeback was unjustified, you may have legal options. Some businesses choose to pursue legal action against the cardholder. Consulting an attorney can help you determine the best course of action.

💡 Remember: Chargeback deadlines are strict! If you want to dispute a chargeback, you must respond quickly and provide strong supporting evidence.

How to Reduce Chargebacks (and Keep More of Your Hard-Earned Revenue)

Chargebacks can be frustrating, but many are preventable. Here are some simple but powerful ways to reduce disputes:

Keep detailed records – Save receipts, invoices, tracking numbers, and proof of customer communication. These can be vital in disputing a chargeback.

Respond to chargebacks promptly – If you receive a dispute notice, don’t delay. Gather your evidence and respond within the required timeframe.

Make policies crystal clear – Display your refund and return policies prominently on your website and receipts. The more transparent you are, the less confusion there is.

Use clear billing descriptors – Customers should recognize your business name when they see a charge on their statement. If they don’t, they may dispute it.

Deliver as promised – Ensure products ship on time and match their descriptions. Communicate delays proactively.

Know chargeback reason codes – Understanding why chargebacks happen can help you address and prevent common issues.

How Basys Supports You

At Basys, we facilitate payment processing and help you navigate chargebacks with confidence. While we can’t overturn a chargeback decision, we can guide you through the process, help you understand why it happened, and give you tools to minimize future disputes.

If you have questions about chargebacks or want to optimize your payment processing strategy, we’re here to help.

By staying informed and proactive, you can reduce chargebacks and keep your business running smoothly.

General Contact

"*" indicates required fields